PCI DSS Assessment

Comprehensive review of your systems against PCI DSS and identification of security gaps.

End-to-end security solutions for cardholder data environments

Comprehensive review of your systems against PCI DSS and identification of security gaps.

AI-driven scanning to detect weak spots across your payment infrastructure.

Official PCI DSS certification and security seal once compliance is achieved.

The Payment Card Industry Data Security Standard (PCI DSS) governs organisations that process, transmit or store cardholder data. Compliance is both a legal obligation and critical protection against costly breaches.

We guide you end-to-end through the certification journey – from the initial gap analysis through implementation of required controls to the final audit.

Certification matched to transaction volume

More than 6 million transactions per year. Highest security requirements.

1–6 million transactions annually. Extended security controls.

20,000–1 million transactions per year. Standard security requirements.

Fewer than 20,000 transactions annually. Foundational security controls.

Our security scanner leverages artificial intelligence to analyse your estate. It highlights potential vulnerabilities that could jeopardise PCI DSS compliance.

You receive a detailed report for every finding with prioritised remediation guidance.

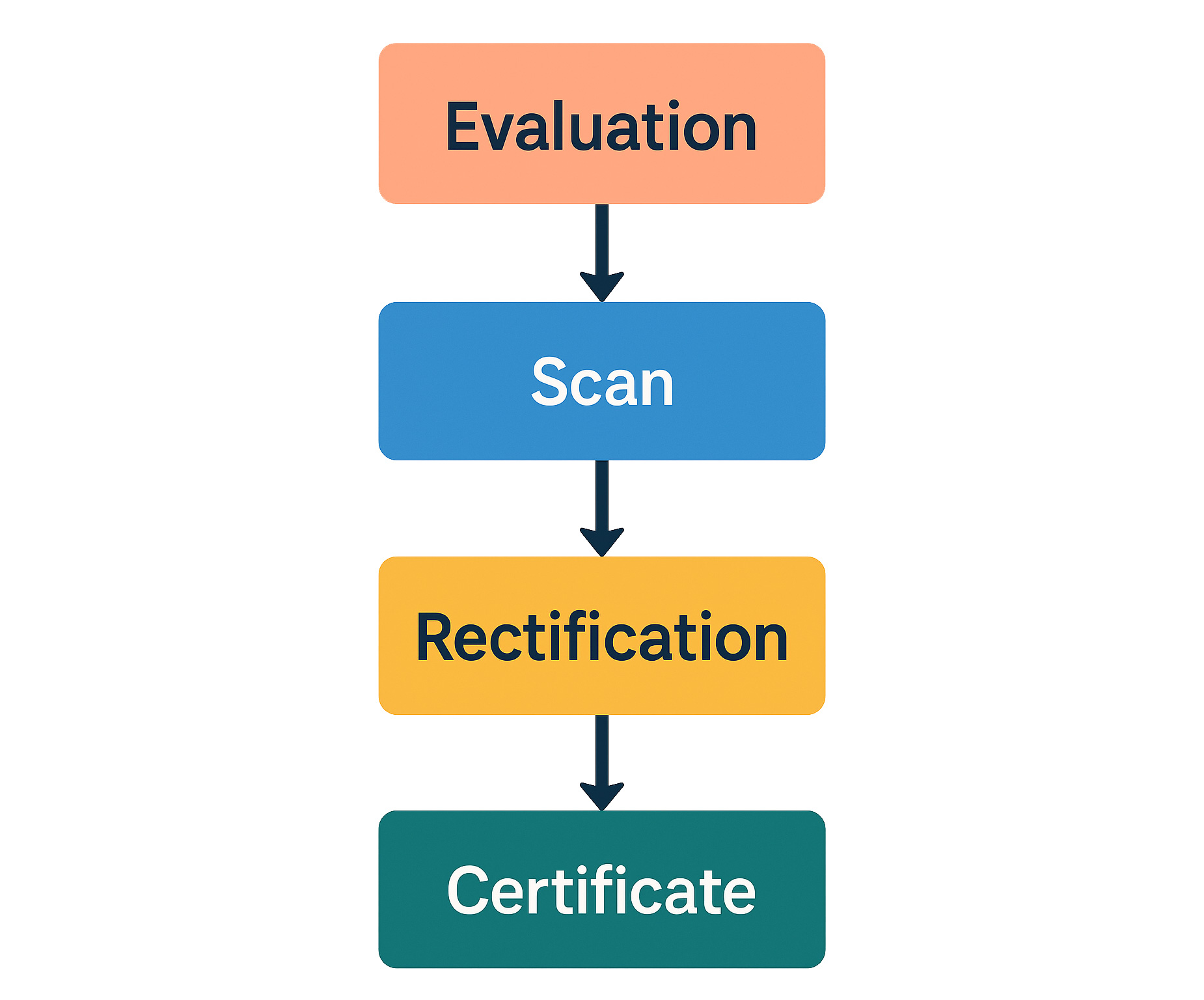

We begin by identifying all systems that touch cardholder data. Next we determine the appropriate certification level (1–4), primarily based on the annual transaction volume your systems process.

After the systematic vulnerability scan we remediate every identified issue. Once all requirements are satisfied you receive our official certificate and security seal.

The core domains of the standard

Firewall configuration and resilient network architecture to protect cardholder data.

Tight access management and authentication for every system handling cardholder data.

Encryption of cardholder data at rest and in transit.

Our certified security specialists remediate discovered vulnerabilities on your behalf. We implement the required safeguards and ensure full PCI DSS compliance.

From network segmentation and encryption deployment to monitoring configuration – we deliver fully compliant systems.

PCI DSS is a continuous programme rather than a one-off certificate. We provide recurring compliance checks and monitoring services to ensure your environment consistently meets the requirements.

Quarterly vulnerability scans, annual assessments and continuous monitoring of your payment landscape deliver lasting compliance and protection against breaches.

Answers to the most common certification queries

Every organisation that processes, stores or transmits cardholder data must comply with PCI DSS. This includes online retailers, payment providers, restaurants, hotels and all other entities accepting card payments.

The level is determined by your annual transaction volume: Level 4 (under 20,000), Level 3 (20,000–1 million), Level 2 (1–6 million) and Level 1 (over 6 million transactions). Each level comes with specific requirements.

The timeline depends on your current security posture and system complexity. Well-prepared environments take 2–4 weeks; extensive remediation projects can take 2–3 months.

Pricing depends on the PCI DSS level and the extent of required remediation. We offer a free initial consultation and provide a tailored proposal based on your specific environment.